he Canadian brand introduced retail to athleisure. Now Brooks Brothers sells stretch dress shirts and Levi’s owns a yoga business.

ululemon is practically synonymous with athleisure. The retailer has frequently been credited with the rise of yoga pants and leggings, effectively creating a new category of activewear. But Lululemon didn’t just change the athletics space by helping birth the athleisure movement, it changed apparel.

A search for “athleisure” in SEC filings yields more than 650 results going back to 2001. That includes Lululemon’s filings, as well as athletics retailers like Dick’s Sporting Goods and Foot Locker, but the term is also listed in filings by a host of general apparel retailers, including PVH, Stitch Fix, Designer Brands and Iconix Brand Group. The majority (more than 450) of those references are from the last five years.

Matt Powell, senior industry adviser for sports with the NPD Group, pegs it at about a decade ago when athletic apparel started gaining popularity as streetwear. It was closer to five years ago, though, when the rest of retail “started to wake up to the potential” of athleisure. Merriam-Webster, for what it’s worth, added the term “athleisure” to the dictionary in 2016.

“One thing I remember very vividly: We were at a company event in New Orleans and after the event was over, I was leaving through the airport and there was a kiosk selling Mardi Gras yoga pants at the end. I said to myself, ‘If I can buy yoga pants at the airport, I can buy yoga pants anywhere,’” Powell said in an interview earlier this year.

Lululemon itself was founded in 1998, closer to the time people were wearing licensed sports apparel as casual wear, according to Powell. But the company came about amid broader casualization trends that dated back to the ’70s and the aftermath of the youthquake movement, which looked to youth culture for fashion inspiration.

Those trends accelerated throughout the ’80s, according to Shawn Grain Carter, a fashion business management professor at the Fashion Institute of Technology, as tech entrepreneurs in Silicon Valley began wearing T-shirts to work. Athleisure itself gained steam in the late ’90s, by her account, reaching mainstream acceptance in the early-to-mid 2000s.

“From the late ’90s to the early 2000s, athleisure became a phenomenon in the United States because it was a niche segment of the marketplace where you could target men and women, young and old, to wear this kind of casual, lifestyle, multipurpose fashionable attire,” Carter said.

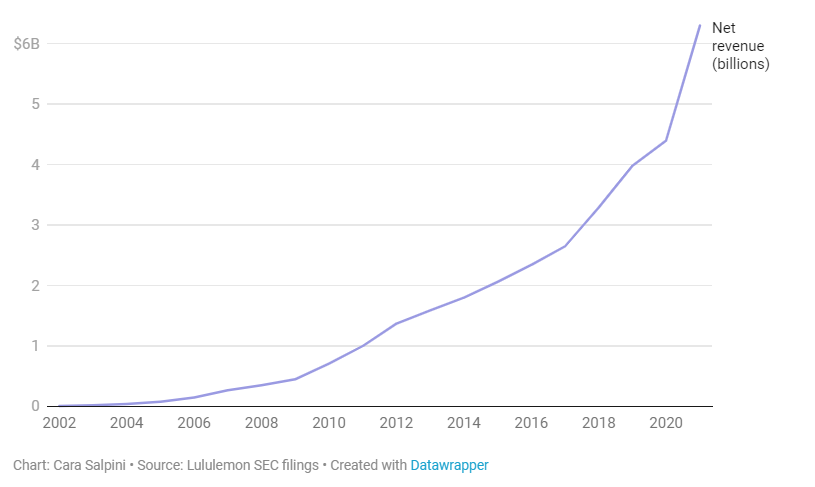

Lululemon’s revenue has increased six-fold since 2010

Lululemon’s revenue, in billions, from 2002 to 2021.

And as athleisure took hold, so did Lululemon’s sales. In 2002, Lululemon made just $5.9 million and by 2021 the retailer was making more than $5.9 billion. In fact, the retailer’s most recent annual revenue, clocking in at $6.3 billion, overtook Under Armour’s. Lululemon IPO’d in 2007, with 59 stores and a promise to finally solve women’s athletic wear gaps.

“Our heritage of combining performance and style distinctly positions us to address the needs of female athletes as well as a growing core of consumers who desire everyday casual wear that is consistent with their active lifestyles,” the company said in its prospectus.

The broader apparel market would soon follow suit.

When the athleisure wave hit apparel

How did the Lululemon effect infiltrate the broader apparel space? Much of the shift happened thanks to changes in consumer behavior around special occasion-wear.

Take work, for example. A Levi Strauss survey found just 7% of the workforce dressed casually in 1992, Carter noted. By 1999, that number had jumped to 75% of the workforce. Carter, who worked at Bergdorf Goodman around that time, began getting questions about how retailers were supposed to dress women for “business casual.”

“When you think about the history of dress attire, it used to signify not only your economic status, but it signified a particular occasion,” Carter said. “You go to work, you have work clothes, you have career clothes. When you’re engaging in sports like tennis, lacrosse or baseball, you have your athletic clothes, your tennis clothes.”

Those lines blurred, causing a “sea change” in how people dressed, Carter said.

The barriers between occasion and everyday clothing have collapsed even further since then. Even denim — the long-time casual garment of choice — was no longer casual enough. Imports of women’s elastic knit pants exceeded blue jeans in 2017. Powell recalled one particular visit about five years ago to a trade show in Las Vegas, called Project, that illustrated the shift.

“For decades, it was a denim show. And there’s just booth after booth after booth of people selling high-end denim jeans. And all of a sudden one show, everybody was selling yoga pants and the denim thing was completely abandoned,” Powell said.

Some financial metrics also point to the mid-2010s as a period when athleisure — and Lululemon — really took off. Tom Nikic, senior vice president of equity research at Wedbush, notes that over the past decade or so, 2014 was the lowest year of same-store sales growth for Lululemon. At the same time, Under Armour’s growth began to slow in about 2016.

“I think if there’s probably any milestone that you would point to, it would be that moment in time when Under Armour hit the wall in their growth and things really started to slow there,” Nikic said. “Because I mean, Under Armour is your prototypical on-court, on-field, performance technical product that you wear to work out and you don’t wear for many other occasions.”

Sports-inspired apparel, which is where Euromonitor International places athleisure, nearly doubled between 2011 and 2021. Between 2016 and 2021, the market grew 42.2%, according to Euromonitor data shared with Retail Dive. That category includes both athletics retailers selling non-performance apparel, and general apparel brands like H&M, Zara and Gap that sell sports-inspired products.

H&M and Zara are not traditional athletics players, nor is J.C. Penney. But the casualization of the U.S. more broadly has pushed retailers of all types toward athleisure. In the past five years, Lululemon has been listed as a competitor in SEC filings that include Levi Strauss (before its Beyond Yoga acquisition), American Eagle and other general apparel retailers.

“This was probably one of the first brands that really sort of blurred the line between athletic and not athletic clothing,” Nikic said.

Now, Brooks Brothers sells stretch dress shirts and Cole Haan offers dress shoes with sneaker-like outsoles.

“It’s really changed the whole industry in pretty much every way you can imagine,” Powell said, with different sides of apparel moving toward a middleground. “It really becomes more difficult to even talk about athleisure today because the boundaries are so blurred.”

A prime example of that blurring is Lululemon’s ABC pant, which looks like a work style but advertises four-way stretch and was “designed for on the move.” The product details also say it was inspired by a classic pair of jeans.

“You’re not going to go out running in a pair of ABC pants, you’re not going to go into the gym wearing a pair of ABC pants,” Nikic said. But they work for scenarios like commuting and work, and are more comfortable than the traditional choices in those categories. “Rather than having to say, ’OK, well I bought my gym shorts at Lululemon and then I go out, I buy my pants to wear to work at J. Crew’ or something like that, you can basically just have one of these brands become your one-stop-shop.”

Nikic estimates Lululemon’s men’s assortment is close to half non-athletic clothing like the ABC pant or polo shirts. Up-and-comer Vuori, too, which was inspired by Lululemon’s success, sells a “Meta Pant” which it bills as “nice enough to wear to the office, or for a game of golf.” The pant also touts stretch fabric and “every day comfort.”

The ability to wear athleisure or athletic-inspired clothing in a variety of social situations has broadened the reach of the category, and eaten into others. Athletic footwear, for example, became the largest part of the footwear business in the U.S. within the last decade, Powell said.

“There are articles out there about, ‘Did the pandemic kill the men’s suit business?’ as an example. And it didn’t, but the men’s suit business is much, much smaller than it ever was,” Powell said. “Same with, say, men’s neckties or women’s dresses or high-heeled shoes. And that doesn’t mean some people aren’t buying these products, but they’re buying much less of them than they have.”

How $100 leggings have endured

Casualization was a well-timed wave Lululemon and the broader athleisure market caught, but why did the style stick?

Part of that answer may lay in the style of athleisure clothing. Lululemon made yoga attire “kind of sexy,” Carter said. Women could dress it up by adding accessories or wear it casually running errands and not worry about looking “frumpy.”

“What people like about this type of specific casual clothing is that yes, it’s multipurpose, but it’s supremely comfortable and it’s got a casual, hip, attitude about it in terms of the style,” Carter said.

When Title IX passed in the ’70s — more than two decades before Lululemon was founded — it opened the floodgates for women to play sports and participate more in all kinds of exercise. Retailers that had long focused on men began developing a strategy for women’s activewear, but the women’s space operated differently from men’s.

Men’s offerings were usually “all about performance,” Carter noted, but women want to look good in their activewear as well. And where other athletics brands lagged, Lululemon emphasized women from the start and went beyond functionality in its offering.

“Traditionally the types of yoga apparel you could find were strictly for you to wear, but not to impress. And Lululemon made yoga apparel sexy,” Carter said. “It made it stylish and it made people want to wear it, whether they did yoga or not — and that was a game changer. Good for them, because they filled a niche. And they were wise to do it at a time when the lifestyle was changing among Americans.”

In emphasizing style, Lululemon cracked the code on desirability, frequently charging upwards of $100 for a pair of leggings. According to Statista, the price per unit in the tights and leggings market has steadily increased from 2014 to 2022, and is expected to continue increasing through 2027.

Analytics and research firm Edited found the average advertised full price of men’s and women’s leggings online at U.S. sportswear retailers as of this November was $88.09. That is just slightly under the average price on Nov. 1, 2018, which was $88.91. In 2018, athleisure was already “well and truly ingrained into the fashion zeitgeist,” according to Edited anlayst Kayla Marci. By Edited’s measure, prices dropped in 2019, 2020 and 2021, due to fast fashion players entering the space and taking market share, as well as impacts from COVID-19. Higher raw material and shipping costs have pushed prices back above $88 this year.

“Lululemon made yoga apparel sexy. It made it stylish and it made people want to wear it, whether they did yoga or not — and that was a game changer.”

Shawn Grain Carter

Fashion Business Management Professor, Fashion Institute of Technology

Lululemon is at the front of that luxury positioning. Similarly to its high-priced leggings, the company’s recently-launched footwear offering likewise hovers around $130 to $160 for most of its styles.

“I think everything’s about the status symbol,” Powell said. “If you can justify the cost of a product and have a visible logo [so] that people can see that you spent $148 on your yoga pants and I didn’t … conspicuous consumption has always been a piece of the fashion side of the business.”

What has allowed Lululemon to stay on top is slightly more complex than just style, though. The company has increased its assortment through its new footwear offerings (which were specifically made for a woman’s foot), expanded into adjacent workout activities like hiking and golf, and importantly, never taken the foot off the gas in terms of product.

“Product innovation, first and foremost,” Nikic said when asked what has made Lululemon so successful. “The product is great — everybody loves it, everybody who wears it loves it. They constantly refresh things: new fabrics, new styles, new patterns.”

In particular, Nikic highlighted Lululemon’s ability to create fabrics for different exercises that have distinct purposes and distinct feelings.

“You could have the best marketing in the world, you could have the best website in the world, whatever,” Nikic said. “Not going to matter if your product stinks.”

Is there any going back?

Cliches have taught us that nothing is forever, that all things change. Denim is a good example: The skinny jean, which reigned supreme for so long, seems to have ceded its place to decades-old styles like mom jeans and flare-leg pants. (Lululemon itself has caught on, touting flared yoga pants and oversized sweaters on its website.) Does that mean an eventual death for athleisure as well?

“Athleisure is here. It’s not going anywhere because people are now working from home and they’re participating in the great resignation,” Carter said. “They’re not going to wear a suit to do that.”

All the same, signature outfits like the little black dress aren’t going anywhere either, Carter said. People will still dress up for certain occasions, they’ll just continue to dress down as well. The idea of healthy living has also caught on more broadly and is driving interest in activewear and athleisure, according to Powell.

The pandemic bolstered that trend as well, with consumers more conscious of their health and more interested in staying comfortable. Post-pandemic, many shoppers expressed a desire to get out in public again and dress up more for events, but according to Powell that did not correspond to an overhaul of their closets.

“Maybe they went out and bought a dress or two, or a suit or two, but they didn’t say ‘I’m not wearing activewear anymore,’” Powell said. “I think comfort and the drumbeat of casualization that we’ve been through for the last 20 years or longer all are part of this. So can there be a dressy business? Yes. Will it be small? Yes. Will athleisure be the big story? Absolutely.”

Lululemon is still a relatively small player, revenue-wise, compared to the global behemoths that are Adidas and Nike. But even looking at those major athletics retailers, athleisure is a critical piece of growth. According to Nikic, Nike’s more fashionable sportswear business has been one of its biggest growth drivers for years. Categories like performance running, on the other hand, have declined as a percentage of Nike’s revenue.

Another way to think about athleisure’s lasting power? Look to history. Nikic, who calls athleisure a “structural mega trend,” recalls a retail executive once telling him that casualization was far longer than a multi-decade trend.

“It’s been a trend since the 1500s. We’re not walking around with top hats and canes,” Nikic said. “This is just the way of the world: It’s just getting more casual, we want to be more comfortable. And that’s probably not changing anytime soon.”